Understanding the Basics of Medicare Supplements

What is Medicare?

Medicare is the federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease. It is divided into Parts A, B, C, and D. The different parts are organized to help cover specific needs.

Part A

Part A is Hospital Insurance that is provided by the Federal Government. It provides coverage for inpatient hospital stays, skilled nursing facility care, and hospice care.

Part B

Part B is Medical Insurance that is provided by the Federal Government. It helps cover doctor’s visits and outpatient care. Also, it provides coverage for some preventative services, occupational therapy, physical therapy, and home health.

Part C

Medicare Advantage (MA) & Medicare Advantage Drug Coverage (MAPD) is provided through Health Insurance Companies. This covers everything Part A & B cover, and often things like wellness and fitness memberships. MAPDs also include prescription drug coverage.

Part D

Medicare Prescription Drug Plan (PDP) is provided through insurance companies and other private companies. This is optional – however if you wait until after you are originally eligible then you may have to pay a penalty.

Together, Hospital Part A Insurance and Medical Part B Insurance, make up original Medicare which is provided by the Federal Government for those eligible. It provides coverage for most of the care you may need, but not all of it.

Medicare does not cover long-term care, most dental care, eye exams related to prescription glasses, dentures, cosmetic surgery, acupuncture, and hearing aids. In some cases, even if a service or item is covered, you generally have to pay your deductible, coinsurance, and copayments.

What is a Medicare supplement plan?

Medicare Supplement, or Medigap, plans are sold by private insurance companies to help with the balance of Medicare-approved services after the original Medicare has paid.

Medigap Important Dates:

• You have 6 months from when you turn 65, or enroll in Medicare Part B, to take advantage of guaranteed issue.

• You can apply any time during the year, but Medical Underwriting may be required.

Note: You must be enrolled in Parts A & B to be eligible.

What types of Medicare supplement plans are offered?

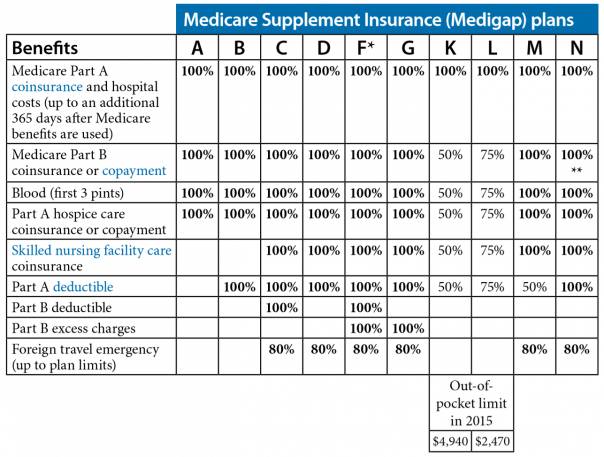

These plans are standardized, but they offer a variety of coverage options. You are not required to use a specific provider network to receive care. Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible Plan F). These are sold in most states. The benefits of each plan within a lettered category remain the same, however, premiums will vary.

* F offers a high-deductible plan. You pay for Medicare-covered costs up to the deductible amount before the plan pays

** N pays 100% of the part b coinsurance except for up to $20 copays for some office visits and up to $50 copays for emergency room visits (if admitted, the plan waives your ER copay).

So how does it work? Medigap lets Medicare pay its share of the Medicare-approved amounts for covered health care costs. Then, the Medigap policy pays its share. This typically includes copayments, coinsurance, and deductibles.

Before you apply for Medicare Supplement plans, it is important to consider a number of things. First, in order to get a Medicare Supplement plan, you must have Medicare Part A and Part B. Second, the cost of premiums, deductibles, coinsurance, and copayments should help you decide which plan is best for you. Third, make sure you pick and research your preferred doctors and hospitals ahead of time – do they accept Medicare assignments?

Ready to apply? Request a quote today.